I personally used OCBC 360 account for my emergency fund, but after the revised i no longer want to park my emergency fund in OCBC.

Here i found after doing research online, i would max out both Singlife and Dash easy earn program.

Highest Interest Rates for Singlife Savings Account

The returns per annum for Singlife Account is 2.50% p.a. for account balances of up to S$10,000.

2.50% p.a. on the first S$10,000 (Returns are not guaranteed)

1.00% p.a. on the next S$90,000

0% p.a. on amounts above S$100,000

Download the app now to earn: https://app.singlife.com/Zv1g3TP1t8

Hence, here go my first 10,000 will park at Snglife to earn SGD20.83/month

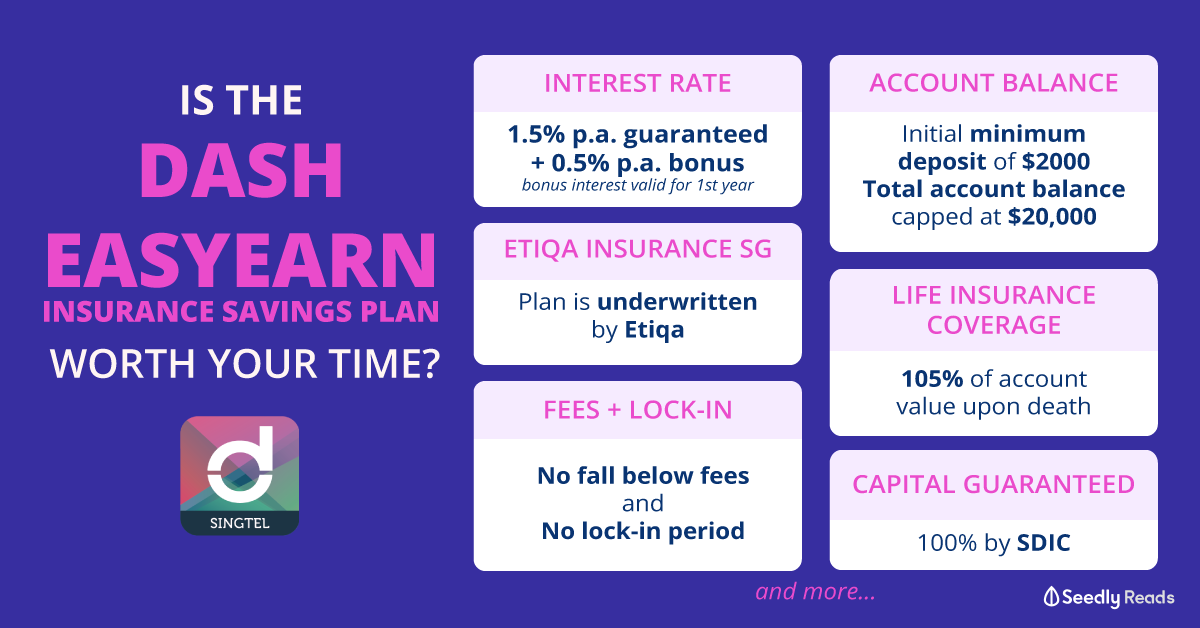

While the balance will park at Dash Easy Earn, Maximum up to 20,000 for 2%p.a.

Read more on: Seedly

To sign up simple here giving you up to $2 cashback for your first Singtel Dash transaction! Sign up with the referral code DASH-C1CPR or tap on this link https://appserver.dash.com.sg:443/mgm?DASH-C1CPR now. T&Cs apply.

Happy growing you wealth !

No comments:

Post a Comment