As we know that the important of the emergency fund which consist of 6 months of your expenses and commitment amount. It is to prepare to in the event you lose source of income and need 6 months to find a new job. While with the Fed lowering the interest near to zero, all the bank in Singapore has revised their interest benefit.

I personally used OCBC 360 account for my emergency fund, but after the revised i no longer want to park my emergency fund in OCBC.

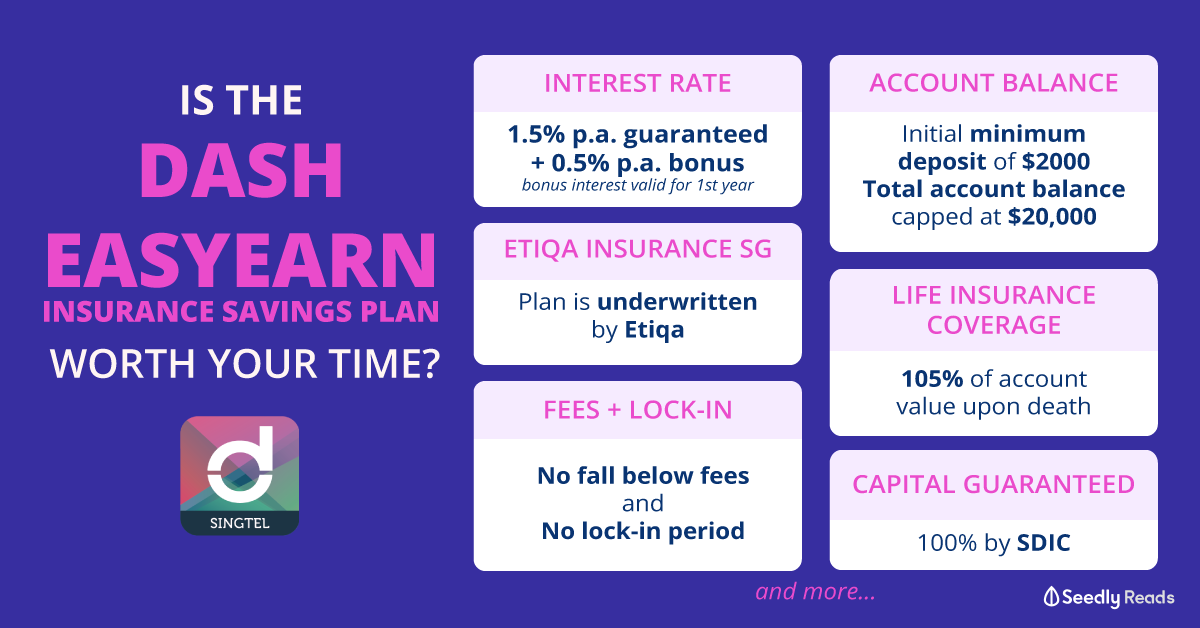

Here i found after doing research online, i would max out both Singlife and Dash easy earn program.

Highest Interest Rates for Singlife Savings Account

The returns per annum for Singlife Account is 2.50% p.a. for account balances of up to S$10,000.

2.50% p.a. on the first S$10,000 (Returns are not guaranteed)

1.00% p.a. on the next S$90,000

0% p.a. on amounts above S$100,000

Hence, here go my first 10,000 will park at Snglife to earn SGD20.83/month

While the balance will park at Dash Easy Earn, Maximum up to 20,000 for 2%p.a.

Happy growing you wealth !